Recalling Beer’s Stock-Offering Wave 20 Years Ago

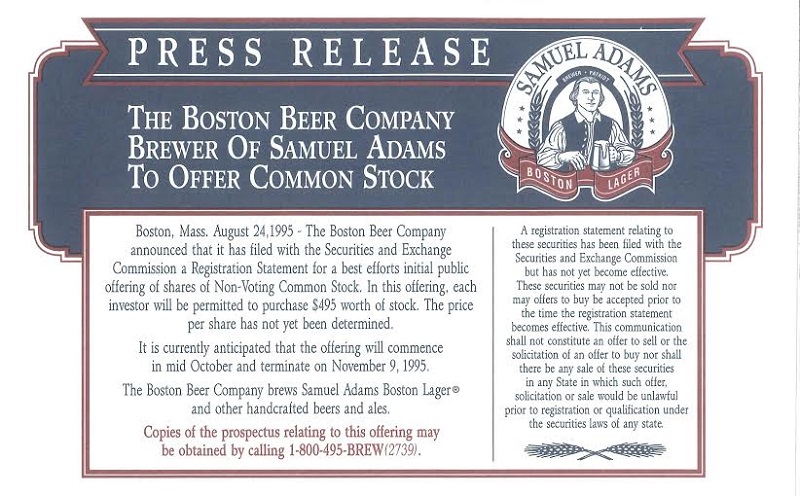

The Boston Beer Co. launched its initial public offering (IPO) on the New York Stock Exchange 20 years ago. (Image courtesy Boston Beer Co.)

The toll-free number popped up on Samuel Adams six-packs in 1995. Consumers who were at least 21 years old could call it and get in on the initial public offering, due that November, for the beer’s parent brewery, Boston Beer: 33 shares per caller at $15 each, or $495 total.

Boston Beer’s IPO, which indeed launched 20 years ago this month on the New York Stock Exchange (ticker symbol: SAM), was the biggest of a wave sweeping smaller breweries then. It was also perhaps the most successful, raising $60 million right off the bat for the 10-year-old concern.

Improbably, the IPO helped drive the worth of Boston Beer’s cofounder and driving force, Jim Koch, above that of Anheuser-Busch Chairman August Busch III. Koch’s shares, including Class B ones that enabled him to control the company, were worth $189 million post-IPO vs. the $108 million value of Busch’s A-B shares. (Though, given the Busch family’s wider holdings, “comparing the worth of Koch to that of Busch is like a gnat on an elephant’s butt,” according to one industry analyst at the time.)

Boston Beer’s main rival in the small-batch beer market launched its own IPO during the same November. Pete’s Brewing Co. out of the San Francisco Bay Area priced its Nasdaq offering (ticker symbol: WIKD) at $18 a share for up to 3 million shares. It emerged with a valuation of more than a quarter-billion and raised $40 million to pay down debt and work toward building a physical brewery in Northern California (like Boston Beer, Pete’s brewed its brands under contract at other breweries).

These IPOs from Boston Beer and Pete’s were immense compared with the vast majority of beer-y offerings during the same period. More typical was that of Frederick Brewing out of Maryland, which initially offered shares for $6 and raised $4.8 million.

Other beer IPOs of the period included the Hart Brewing Co. out of Washington State (symbol: HOPS), which would change its name to Pyramid; the Willamette Brewing Co. out of Oregon, which would change its name to Nor’wester Brewing; the Rock Bottom brewpub chain, started in Colorado; and the Johnson Beer Co. in Charlotte, N.C.

The August 1995 offering of the Independent Ale Brewing Co.—better known as Redhook—really kicked off the wave. It raised more than $33 million initially, including from investors such as Anheuser-Busch, which had already bought a 25 percent stake in the brewery the year before. (This 1994 sale caused a histrionic Jim Koch to label his small-batch competitor “Budhook.”)

Although public stock offerings seemed a sure bet in the 1990s overall bull market, the results turned out to be mixed for breweries. Despite the inceptive monies, many found themselves stumbling by the end of the decade, wilting under a general collapse in the small-batch-beer sector and a national economy about to tip into recession, the era’s dot-com frenzy proving more bubble than boom.

It did not help some of these breweries to have shareholders who understandably demanded returns on their investments. Pete’s, Willamette, Frederick and Johnson would either go out of business entirely or be acquired by larger rivals. Often, these takeovers or failures happened as shares in the breweries slid well below a dollar each.

As for Boston Beer, those $15-a-pop stocks 20 years ago are now trading just north of $200.

Read more Acitelli on History posts.

Tom Acitelli is the author of The Audacity of Hops: The History of America’s Craft Beer Revolution. His new book is a history of American fine wine called American Wine: A Coming-of-Age Story. Reach him on Twitter @tomacitelli.

Leave a Reply