Core Appeal: Amid Strong Growth, Cider Makers Break Boundaries

(Photo courtesy Millstone Cellars)

Whether it’s shelving at grocery stores or taps in bars, cider is slowly taking over real estate once exclusively held by beer.

But as one of the fastest-growing segments of alcohol, finding its place among drinkers presents a challenge as cider makers find a balance between beer and wine. There’s no denying cider is growing rapidly—during a presentation at CiderCon 2016, Boston Beer cider marketer Jon London noted there are now 18 million cider drinkers in the United States compared with about 5 million four years ago. As cider finds more fans, new experiences are rapidly being offered, blending ingredients and flavors that set cider apart while also mirroring other categories of alcohol.

Cider is breaking expectations of just being a sweetened, boozy juice or something only for the gluten-free crowd. It’s getting dry-hopped, barrel-aged and experimented on for a wide variety of tastes and expectations.

“Cider has a long history in the U.S., which helps renewed interest, but it’s also the ability to make it with different ingredients and growing new kinds of styles,” says Kristyn Dolan, editor of Hard Cider News, a trade news website that has covered the cider industry since 2012. “The variety of cider is changing and setting expectations that you’re not going to find the same thing every time.”

In essence, it’s a perfect time for cider, with interest split evenly between genders and consumer research firm Nielsen reporting sales grew six times over from 2011 to 2014, reaching $470 million.

More consumers are looking for new experiences, led by drink-swapping millennials, who aren’t just beer’s most important demographic, but are also twice as likely as the average drinker to pick up a cider, according to Nielsen. Which is fitting, as the number of ciders available in grocery stores and wine and bottle shops has doubled over the past five years. Retail sales of cider were up 12 percent in 2015, according to market research firm IRI.

While beer may have the power of a brewpub right down the road boasting a dozen taps, cider makers are enticing their burgeoning consumer base with an equal amount of flexibility in both product and procedure.

“We don’t put any limitations on what flavors can be in our cider, because it’s a drink that still has a lot of exploration, which makes it fun,” said Curt Sherrer, co-owner of Millstone Cellars, which makes ciders in an 18th century grist mill in Monkton, Maryland, using ingredients like spicebush berries and lemongrass. “Should it have tastes of wine or tastes of beer? It doesn’t have to be either.”

(Photo courtesy Millstone Cellars)

Millstone, which focuses on barrel-aged ciders and meads, has nearly doubled production year-to-year, most recently making about 6,000 gallons in 2013, almost 13,000 in 2014 and roughly 24,000 in 2015. Sherrer’s apple-based creations run the gamut of flavors, from Hopvine, a dry-hopped, cask-aged cider with a touch of raw honey, to Spruced, a barrel cider aged on lemony spruce boughs and wild smoked cherrywood.

“It’s such a new concept to sell these rustic, weird ciders, and people will look at me and ask, ‘Why are you trying to make me drink vinegar?’” says co-owner Kyle Sherrer, Curt’s son. “But now we’re surrounded by a drinking culture, especially with younger drinkers, that constantly chases a new experience.”

In 2016, Kyle Sherrer will look to continue his success with Graft Cider, a new venture in New York unaffiliated with Millstone that will feature dry-hopped and gose-inspired ciders. Sherrer says he’s excited to branch out with Graft in an effort to help push new ideas and innovations in the “creative nexus” of the cider industry—Hudson Valley.

Given the growing assortment of choices, it’s no surprise that cider is drawing comparisons to beer. Not only for the exponential variety available, but also the industry itself. Like beer, which the Brewers Association estimates sees about two breweries opening each day, the number of U.S. cider producers is steadily increasing. Between 2010 and 2015, domestic cideries more than doubled to more than 400, according to Dale Brown, owner and managing partner at the website The Cyder Market. Counting breweries, wineries and meaderies that also make cider, the figure grows to 541.

That total is only getting bigger, as Brown estimates at least 20 businesses will enter the cider market in 2016.

“The craft beer market is getting extremely competitive, and I think the craft cider market isn’t so constrained,” said Nathan Kelischek, brewmaster and director of brewery operations for Appalachian Mountain Brewery in Boone, North Carolina. The brewery hopes to release three packaged ciders alongside its beer in 2016. “We’re trying to diversify our portfolio as much as possible because there’s an opportunity for cider to take a chunk of the beverage market, and we want to be a part of that.”

Appalachian Mountain’s core packaged beers focus on classic styles—a porter, a blond, an IPA and an American pale ale. Adding cider to the mix allowed for more opportunities to expand knowledge and experience with fermentation, Kelischek says. Appalachian Mountain’s best-selling cider has been Mystic Dragon, infused with green tea, rhubarb and strawberries. An initial rollout of packaged offerings will include Mystic Dragon alongside a dry-hopped and apple-only cider.

The company has already received recognition for its cider. In 2015, Appalachian Mountain won a silver medal at the U.S. Open Beer Championship in the “Anything Goes” Specialty Cider category for Cinful Plum, made with cinnamon and plums.

But beer isn’t the only comparison. Thanks to its source—the apple—cider also draws comparison to wine due to its “terroir,” or how its ingredients and their flavors create a sense of place.

Angry Orchard, the cider arm of Boston Beer, producer of Samuel Adams and Twisted Tea, has been the king of American cider since debuting in 2011, replacing Boston Beer’s initial foray into the style with HardCore Cider in 1997. It makes up over 56 percent of the entire U.S. cider market, and its top-selling brand, Crisp Apple, is a top seller in places like grocery and drug stores, Wal-Mart and more.

(Photo courtesy Angry Orchard)

But Angry Orchard is working to go local, kind of. In fall 2015, the company began a new focus on terroir after Boston Beer purchased an orchard in Walden, New York, to act as a research and development facility.

“A lot of people may think sweet cider is the only thing out there, but it’s really a multifaceted category,” said Ryan Burk, head cider maker at the orchard. “Everything we make at our new facility doesn’t have to be for everybody. We’ll get to test what’s challenging and unique to the average consumer with small one-off or seasonal offerings.”

To Burk, making cider is just as much about farming and agriculture as the process to turn an apple into an alcoholic beverage. While a drinker may have a general understanding of words like hops, malt or yeast when it comes to beer, apples are an ever-present crop that people can easily wrap their minds around and are distinctly associated with agriculture.

Once that connection is made, Angry Orchard hopes to bridge a gap with beer lovers by offering complementary tastes to what drinkers might find in their favorite beers. The cidery features a “Ciderhouse Collection” of three ciders using juice blends, wood aging and a variety of yeast strains. Recently, Angry Orchard began its “Orchard’s Edge” series, which features flavors of oak along with ingredients like orange and cardamom. The expanding array of flavors highlights a trend seen from smaller companies like Millstone to the biggest names in cider, like Angry Orchard. As more people expand their attraction to alcoholic beverages, more options are available to a growing collection of “cross-drinkers.”

(Photo courtesy Angry Orchard)

In a 2014 presentation at the Beer Marketer’s Insights Seminar in Chicago, Constellation Brands CEO and president, Rob Sands, noted that 85 percent of dollars spent on alcohol came from beer, but just 10 percent of that was from shoppers who only drank beer. That means that at a time when more options are taking up shelf space, 75 percent of dollar sales come from customers who choose to buy a variety of drinks, whether that is beer, wine, spirits or cider.

That’s not even accounting for America’s growing interest in gluten-free foods, a market that made $11.6 billion in sales in 2015, according to research firm Mintel. Gallup polls have shown about 20 percent of Americans include gluten-free foods in their diet, while it’s an even bigger hit with young people. Mintel reported that 25 percent of the 18- to 24-year-old respondents of one survey said they eat gluten-free.

“Compared to something like beer, cider as an industry is so small right now, which means there’s no reason anyone should focus on just one way of making cider,” says Dolan. “Growth can be immense.”

The wide variety of production and styles available reflects that, from ciders like Strongbow or Stella Artois Cidre to bottles that can retail for more than $100. Anthony Belliveau-Flores, co-owner and co-founder of New York City’s Rowan Imports, says some of his best-selling brands are bottles from Aaron Burr Cidery in Wurtsboro, New York, that retail for as much as $150. Some of Rowan’s other big sellers come from all over the world, including France, Spain and Germany.

“It’s hard not to appreciate the rising tide of it all,” Belliveau-Flores says. “But you look at it and cider in the U.S. seems to be in puberty right now, still trying to figure out what it wants to be.”

These ciders were tasted by beer editor Ken Weaver.

Alpenfire Pirate's Plank Bone Dry & Spark!

ABV: 6.9% & 8.9%Tasting Notes: Two exceptional, unfiltered, bottle-conditioned ciders from Washington’s northwest corner. The bone-dry one, “scrumpy style,” is endearingly tannic as promised: puckering, textured, a particular kind of refreshing. Herbaceous and mineral qualities seem reminiscent of Chablis. The sweeter Spark! is more toward the opposite pole, though with reviving acidity and notes approximating Amaretto and fresh-baked pie, built out expansively despite the higher sugar. If you’re into either profile, both are well worth the effort of tracking down.

Angry Orchard Orchard's Edge - The Old Fashioned

ABV: 6.5%Tasting Notes: This and Knotty Pear are the first releases in the new Orchard’s Edge series. Angry Orchard knows how to make reasonably on-point cider when it wants to, avoiding excess sweetness, and the cherry and orange peels add some endearing holiday-punch notes at the edges here. Soft tannins, restrained sweetness and honeyed pear follow underneath. Sturdily built.

Millstone Hopvine

ABV: 8%Tasting Notes: Both this and the Troy offer up some legit acidity—reminiscent of eye-opening experiences with funky Spanish sidra. There’s some acetonelike, volatile fruitiness poured straight out of the fridge, but a bit of time reveals more deep grassiness from the dry-hopping, denser citrus like lemons and passion fruit, and fresh-cut floral notes via the apples and wildflower honey.

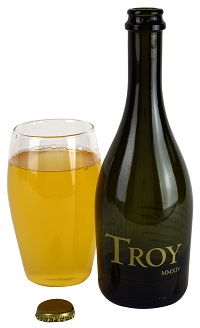

Troy California Hard Cider

ABV: 9%Tasting Notes: Every vintage I’ve tasted thus far of this has been exceptional. As indicated on the label: a wild fermentation and nine months of aging in neutral oak barrels. Notes of red fruit, crisp green apple and honeycomb lead in the aroma, with a touch of vanilla and almond from the oak. Grapefruit and grassy citrus add endearing acidity, and there’s funk here to appease any lambic lover. Expansive terrain that makes you want to drink more cider.

Bryan Roth

Bryan Roth is a North Carolina-based writer. Find him tweeting at @bryandroth.

Leave a Reply